- FREE TAX SOFTWARE FOR 2016 HOW TO

- FREE TAX SOFTWARE FOR 2016 INSTALL

- FREE TAX SOFTWARE FOR 2016 PASSWORD

- FREE TAX SOFTWARE FOR 2016 FREE

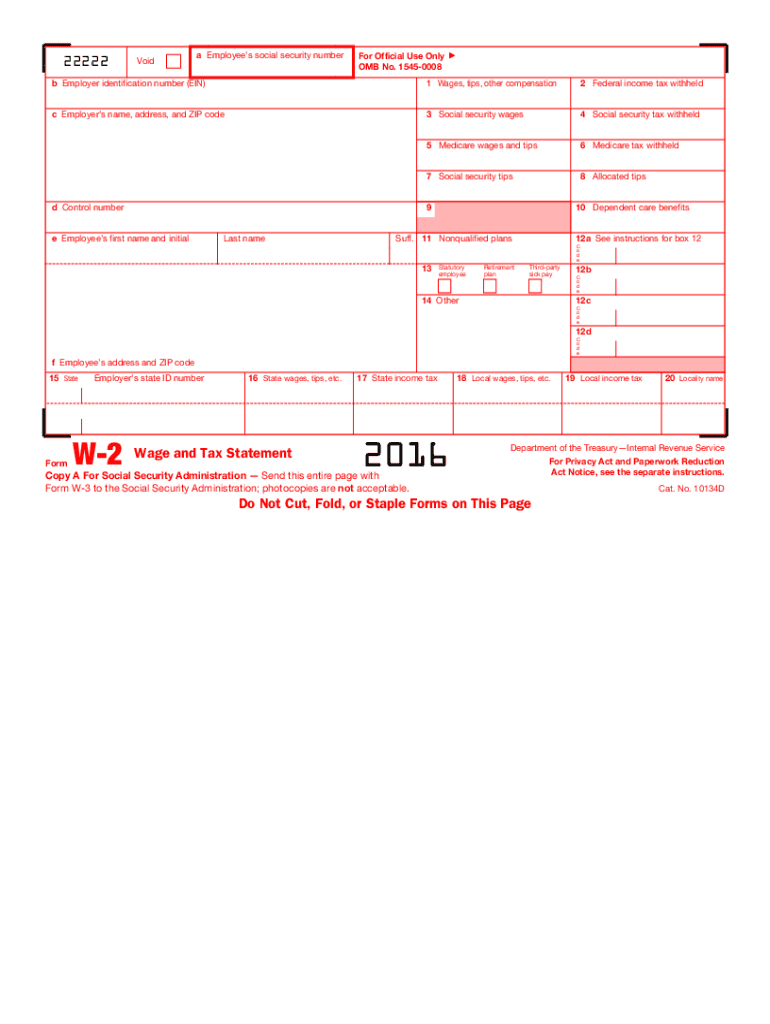

Learn more at Secure Access: How to Register for Certain Online Self-Help Tools. Get Transcript Online users must first pass Secure Access authentication. Please allow 5 to 10 calendar days for mail delivery. Call us before you start, while you're preparing your return, or after you've submitted it.Verify your identity by using your 2016 Adjusted Gross Income or your 2016 personal identification number if you created oneĭon't have your AGI or PIN? If you do not have your 2016 tax return, you may use Get Transcript Online or Get Transcript by Mail to obtain your prior-year AGI. Our tax pros are available to help during business hours.

FREE TAX SOFTWARE FOR 2016 FREE

StudioTax is available free for individuals who prepare their own tax returns or returns for a small number of relatives and friends.

This program has all the CRA & Revenue Quebec certification and approvals for Netfile, printed returns, T1135, and Auto-fill my return. Once your return is mailed and received by the IRS or state, you should expect to receive your tax refund in 4 to 6 weeks. StudioTax 2016 is a tax return preparation tool for Canadians.

You can expect your 2013 tax Refund in 4-6 weeks FreeTaxUSA is a robust online personal tax preparation service that lets you e-file federal tax returns for free, though state filing, and advanced support.

FREE TAX SOFTWARE FOR 2016 PASSWORD

Just pick a username and password to create an account, gather your documents, and get started on your 2013 tax return. If you are also filing a state tax return, the additional cost is $15. That includes unlimited tax and technical support and the option to have your tax return reviewed for mistakes or ommisions.

FREE TAX SOFTWARE FOR 2016 INSTALL

0 kommentar(er)

0 kommentar(er)